Is forex trading really profitable? Many people, especially the newbies and short term traders ask this question. Actually, this is anything but an immediate ‘yes’ or ‘no’ question. According to the strategies and different elements that ascertain success in forex, the appropriate response to the question, nonetheless, would be a ‘yes’.

You may definitely realize that the forex market, otherwise called foreign exchange, is the place where currencies are being exchanged daily by individuals from all parts of the world. The forex market is generally considered as the most exciting financial market because it records over $5 trillion transactions daily. Considering the volume and size of the forex market, it is no big surprise that it continues pulling in and inviting new traders who are keen on acing it and acquiring extra profits.

Many foreign exchange platforms have been coming up within the years, making it feasible not only for big businessmen and large financial institutions but for ordinary individuals to enter the market and effectively begin trading on the financial market as well. Moreover, because there’s a lot of information available out there about how to become a trader and many forex success stories, there is an ever-increasing number of people to invest in learning how to effectively trade and make huge profits in the long run like the top traders out there.

Before having big dreams about forex trading, how about we kick things off by giving you a shred of motivation and inspiration. This article will explore the success of the top 3 traders in the financial market and their net worth, to hopefully draw out the inner trader in you.

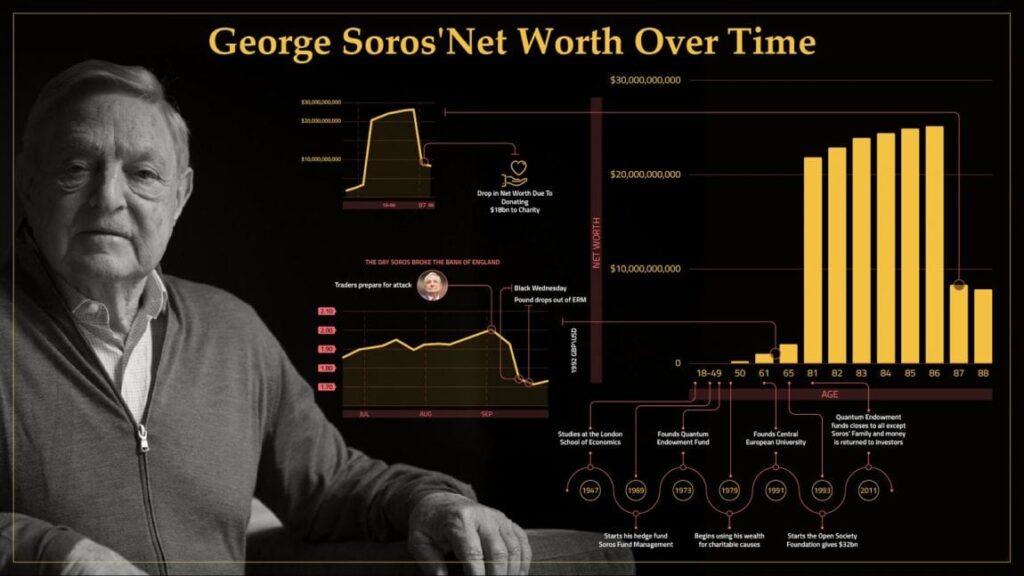

George Soros

From settled traders to newbie dealers, we are certain that nearly everybody knows the tale of the man who broke the Bank of England. How did George Soros arrive at that point and what happened thereafter? Soros is an acclaimed hedge fund big shot who gained popularity after making a billion in just one day shorting the British pound. From 1969 to 2011, he created his company in New York, where he managed all his clients. He established a hedge fund in 1973, which was later known as the Quantum Fund. The defining moment of his career, though, occurred in 1992 when he wagered against the British Pound and supposedly made the huge fortune of $1 Billion. Which made him popular as the man who used up every last cent of the Bank of England and will likewise stand out forever as the first person to have made such a huge amount in just one day.

He is the CEO of Soros Fund Management, LLC, a firm that oversees speculative stock investments. Since its opening, the organization has created around $40 billion in profit. That, as well as making over $14 billion in grants through Eastern Europe Open Society Foundations, the Central and Quantum Fund. Soros has guided his organizations towards supporting individuals and different associations around the globe, fighting for uniformity, the right to speak freely and that’s just the beginning. Soros himself gave $18 billion of his fortune to charity in 2017.

He is renowned for his philanthropy and is attempting to improve the world one step at a time, by sharing his fortune and accomplishments to as many people as possible. That, as well as his thoughts and perspectives on trading, investing, and financial aspects, has been trailed by numerous traders around the world. Many forex brokers are still learning from George Soros as he is one of, if not the best FX traders in the world. For example, the T1markets broker sometimes provides quotes from Soros himself to its clients so that they’re a bit more clear about bank actions and so on. As you’ve probably guessed George Soros has to be one of the people you talk about in the article.

George Soros was very hard-working and didn’t receive any had-outs from friends or family. He was conceived in Hungary yet his family needed to remain in isolation to evade extradition to a Nazi death camp. He left the country at 17 years old to seek after his objectives and dreams. Soros studied at the London School of Economics, which he funded by himself, and later worked as a railroad doorman and a dance club server. And now he is worth over $8.6 billion after donating $32 billion of his personal wealth to charity.

Ray Dalio

Dalio’s childhood neighbourhood was in a middle-class Long Island and entered the markets at 12 years old. He gathered money by getting tips as a golf assistant. The majority of the golf players he assisted worked on Wall Street and that is the thing that got him inspired to start trading stocks. Dalio went to the Harvard Business School, where he studied Business and graduated with a Masters in Business Administration in 1975 and started his company, Bridgewater, from his apartment in New York City, thereafter. The organization’s prosperity soared during the ’80s and by 2011 it became the biggest hedge fund globally. Today, the investment firm oversees about $160 billion in resources.

Dalio predicted the 2007 crisis in the financial market. He further clarifies his strategy in an essay he wrote teaching economists how the markets work. His net worth is a whopping $16.9 Billion.

Besides his popular essay, he distributed a book, called “Principles,” applauded by numerous speculators and dealers worldwide. In his book, Dalio clarifies in detail the way of thinking behind his investments in view of his own corporate experiences. A portion of the principles he advocates more youthful brokers and businessmen to watch more experienced dealers, keep their integrity, and to analyze events.

Ray Dalio, among the rest of the top rich investors in the world, also enjoys giving to charity. Over the years, Dalio has spent about $700 million as donations to various charitable foundations. The Dalio Foundation also funds microfinance, inner-city education and nature conservation.

James Simons

James Simons is unquestionably one of the most fascinating figures on our rundown on the grounds that, despite being a very rich person in hedge funds, he is likewise a mathematician and a quantitative financial specialist, known for his renowned examinations of string theory development and pattern recognition. In the trading network, he is known as the world’s most intelligent tycoon. James was born in Newton, Massachusetts, in 1938. As a youngster, he worked in a garden store. James got his PhD in Maths at the age of 23. He was very hard-working, curious, and determined to make it through.

He dreamt of combining his passion for maths and trading, which drove him to build up a group of professors, engineers, and scientists who assembled an algorithm to foresee any adjustment in the price of a money related instrument. His thoughts turned into the establishment of what is today considered as the “quantitative financial investor”. James Simons established the renowned Renaissance Technologies, which made him an extremely rich person and got one of the world’s best hedge fund organizations.

He uses numerical models to assist him with reviewing hedge funds and end up with more precise predictions than other strategies. He is a specialist in the pattern recognition strategy. Just like the other top experts, James Simons is a philanthropist and has donated an estimated $2.7 billion to different charitable causes throughout his life. He is currently worth over $23.5 billion.