As you are already well aware – getting a college degree doesn’t come cheap. Paying for your college or university tuition can put you in a soul-crushing debt that you simply can’t get out of, or at least not the next 30 years upon graduating.

Now, what do you do in those situations? How can you make your life easier and finally get rid of that debt? Well, you consolidate your student loan. Should you do it? We don’t know. What we do know is, we can tell you all the good and the bad stuff of consolidating students loans, so you can make an informed decision based on that.

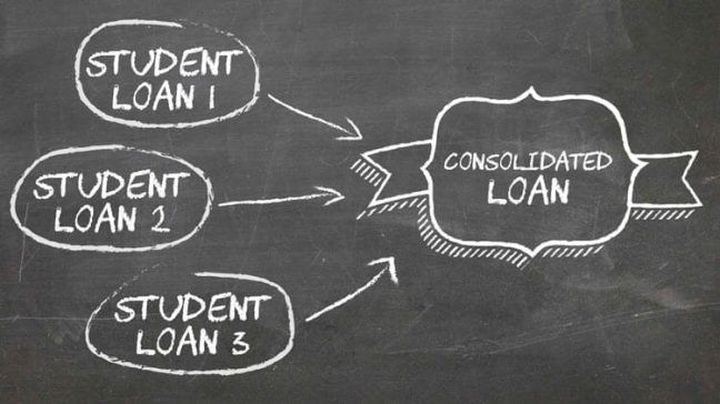

What Is Student Loan Consolidation?

Essentially, consolidation is a way for you to repay your students loans in an easier way and perhaps manage to save some money along the way. You would combine all of your outstanding student loans and take out another loan to cover all of them. That way, you streamline all of your monthly payments into a single one, possibly with a lower interest rate, and you’re good to go. To be fair, you will still be in debt, only under different circumstances, hopefully, better ones.

How To Take Out A Consolidation Loan?

Taking out a consolidating loan is pretty straightforward. You’d go to a bank or any other lender, submit all the necessary documentation, and wait for the approval. Once you’re done with all of that – you’d receive funds, payout your student debt and gradually pay off this one. However, you have to be careful where you take the money from, as there is more than one way to make things a lot worse than they were. So, be careful and make sure to learn more about where you should or shouldn’t take out a consolidation loan.

Should You Do It?

As we’ve said in the beginning, we can’t tell you whether you should do this or not – that decision is entirely up to you. We can only advise you to be financially responsible and do your research, but beyond that, we can’t help. However, what we can do is present you with a list of pros and cons, so you can decide whether the good outweighs the bad.

The Pros Of Consolidating Student Loan

1. Streamlining Your Monthly Payments

As you probably know, most students take out student loans once every semester and depending on how long they’ve been at the university or college, the number of monthly payments can vary. The problem with this is keeping track of all of them.

Instead, what you can do is take out a single, massive loan that covers all of your outstanding student loan debt and turn all of your monthly payments into a single one. Now, this won’t make much of a difference as far as saving money goes, but what you will get is a lot more free time on your hands.

2. Avoiding Default

Once you take out a consolidating loan, you will be able to set the terms however you like them, at least when the payment date is concerned. You will be able to set things up in a way that you’re always confident you will be able to pay the monthly fee on time, avoiding default and staining your credit score. Each missed payment lowers your credit score and will show up on the credit report for the following seven years.

3. A Single, Fixed Interest Rate

Another neat thing about streamlining your monthly payments is fixed interest rates. With many loans, there are many interest rates that you have to keep track of. On the other hand, with a consolidated loan, you get a single, fixed interest rate based on the average of the interest rates of the debts being consolidated, and that rate stays the same for as long as you’re repaying the loan.

4. Lower Monthly Payments

When taking out a sizable loan to cover the student loans, you have plenty of options as far as repayment plans are concerned. You can select a repayment plan for up to 30 years. If you do choose a repayment plan that spans over three decades, your monthly payments are definitely going to be lower, and if you manage to a lower interest rate – you’ve hit the jackpot.

The Cons Of Consolidating Student Loan

1. Pay More Over Time

If you choose one of the extra-long repayment plans to lower your monthly payment, you will end up paying a lot more in interest over time, meaning over the long run – you will spend more money than you would if you were to just keep repaying your student loans the old way.

2. Above “Average” Interest Rate

The interest rate you get with a consolidating loan isn’t exactly an average of all the outstanding loan interest rates. It is, in fact, an average interest rate, plus 0.125%. Now, that doesn’t seem like much, but if we’re talking about a large sum, over time, that will result in a lot of money.

3. You Can’t Consolidate Private Student Loans

If you’ve taken a student loan from a private lender, you can’t rely on the Federal Consolidation loan program. That only works if you’ve taken out a federal loan. On the other hand, you could consolidate your student loan debt from a private lender, but you would probably have to pay a slightly higher interest rate.

4. You Can’t Do It Twice

As we’ve said, with these kinds of loans, you get a fixed interest rate based on the weighted average of your outstanding loans. That interest rate is there to stay. However, what could happen is that the student loan interest rates could drop over time, but regardless, you won’t be able to change the fixed interest rate you’ve already gotten. Once you repay your student loan debt – you’re left with repaying the consolidation loan at a fixed rate, and there’s nothing you can do about it.

Conclusion:

There you have it. Those were the pros and cons of consolidating a student loan. Hopefully, you’ve found this helpful and will now know what to do.